Update: This article was last updated on 29th November 2023 to reflect the accuracy and up-to-date information on the page.

Knowing how to manage one’s money effectively is a vital life skill that can profoundly affect one’s financial security. Research shows that just a fraction of the global population is financially literate.

According to a study by Forbes, only 30% of public school students in the United States have access to classes on money management. Experts agree that teaching children about money matters early on is crucial. Although people have differing views on the topic, teaching kids about money is a good thing.

Why is it important to teach my child about money

from an early age?

Helping your child develop financial literacy skills is like giving them a superpower that can benefit them for their entire life. Here are some of the great things that can happen when your child learns about money early on:

- This can help them make better choices with their money as they get older. They’ll understand the importance of earning money saving it and spending wisely.

- They’ll be better at making decisions about long-term investments, like buying a house or starting a business. This can provide them with financial security.

- They’ll be less likely to take on debt, especially expensive debt with high-interest rates. This can save them a lot of money in the long run.

- They’ll have a better credit score, which can make it easier to borrow money for things like a car or a mortgage. Also, it will make it easier for them to achieve their financial goals.

Studies show that kids who learn about money from a young age are more likely to make good financial decisions later in life. So, start talking to your child about money today and give them the tools they need to succeed.

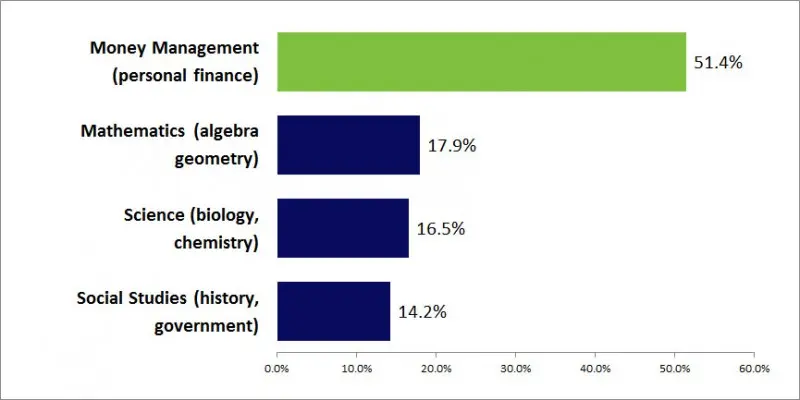

Source: Financial Educators Council

Between March 21 and 22, 2016, 1,101 18-24 year-olds across the United States responded to a financial literacy survey conducted by the NFEC to assess young adults’ feelings regarding high school-level courses that would benefit their lives. This online survey produced statistically significant results with a 99% confidence interval and a less than 4% margin of error.

Debating the Importance of Financial Education for Kids

There have been many discussions and conversations for a long time about whether teaching kids about money matters is a good idea. Unfortunately, many people think it’s okay because kids are already growing up in a complicated world, and there’s no reason to keep them from learning how much money affects our lives. With the proper financial education, kids can learn about these basic ideas early on and know how to keep a healthy relationship with money.

How Can Financial Literacy Help?

Every part of a person’s life is affected by how well they understand money. It is essential for kids if they start learning about money when they are young; it can help them in the long run. But on the other hand, not knowing enough about money can lead to bad spending habits and too much debt.

Reversing bad financial habits is more complicated than making good ones, so teaching the younger generation about money is essential. When kids learn how to handle money at a young age, it can help them become financially stable as adults.

5 Benefits of Financial Education For Kids

Money is needed everywhere, whether you like it or not, and your kids will have to learn how to use it to pay for things, even the most privileged ones, at some point. Money is essential for things like putting food on the table and keeping a roof over their heads.

They should learn this from a young age. Here are the top five reasons why kids need to learn about money:

1. Accurate Information

Failing to educate your children about finances can have negative consequences later. Although schools provide some education on financial literacy to teenagers, they might also be influenced by misinformation from friends, acquaintances, or adults with poor money-management abilities. Many schools also do not have financial education courses.

For example, as teens age, they may wish to splurge due to peer pressure on unnecessary things like expensive clothes or gadgets. However, with even basic financial knowledge, they will realize this is a “want” they must budget and save for.

2. Learning the Difference Between Wants and Needs:

As an adult, you might understand the difference between your wants and needs, but your children do not, especially when tweens and teens feel like they need everything they see in a store. Teaching children about money can aid in their ability to differentiate between necessities and desires, allowing them to avoid accumulating debt.

3. Well-informed Decisions:

The ability to make smart financial decisions early can significantly impact one’s financial health in the long run. Financially literate individuals are better equipped to navigate the complexities of the financial world. They can also make informed decisions about which financial products to use, such as credit cards, loans, or investment accounts.

4. Understanding Bills and Purchase Receipts:

Money plays a prominent role in everyone’s daily lives, making financial literacy an essential skill to acquire. Opportunities to teach financial literacy to exist in everyday activities, such as shopping.

Parents can take advantage of the shopping experience to teach children about credit and debit cards, how cash is used, and the significance of purchase receipts, which include itemized costs and other pertinent details. By incorporating financial literacy lessons into everyday experiences, children can develop a strong foundation for financial management.

5. Saving Money:

Encouraging children to understand the relationship between expenses, income, and savings is crucial to their financial literacy. It is essential to teach children that saving is a critical aspect of managing expenses, and they should prioritize it.

One approach to instilling this habit in children is to encourage them to save some of their pocket money regularly. It will enable children to appreciate the value of saving and develop a sense of independence in managing their finances.

Moonpreneur

In short

Starting conversations about money with kids at a young age can help them deal with unexpected costs and keep them from worrying about money in the future. Knowledge and skills about money are also valuable assets that can help them throughout their lives and set them up for success as financially responsible adults.

Moonpreneur understands the needs and demands this rapidly changing technological world is bringing with it for our kids. Thus we are on a mission to educate and ignite the flames of entrepreneurship through our holistically created online STEM programs, which will help kids master the futuristic sciences such as Robotics, Game Development, App Development, Advanced Math, and much more!

Register for a free 60-minute Robotics class today!

How can I ensure that financial literacy is an integral part of my child’s education, regardless of background?

If we want to make sure that all kids, no matter what their background is, have access to financial education, we need to make sure that it’s part of the national curriculum. This means making sure that financial literacy is taught in schools in a disciplined and age-appropriate way, and that teachers are trained to do it. We should also work with neighborhood groups and use the internet to reach kids from different backgrounds.

Teaching kids about money has its drawbacks. It can be complicated and hard for kids to understand, which will distract them. It also focuses on traditional financial products that will not be suitable for everyone. It will also give kids the wrong idea about money, like predatory lending. Plus, it will be expensive and take away from other important classes like math and science.